- The technological sophistication of modern automobiles means that they are very different from the models of the past.

- In many areas conventional mechanical systems have been replaced by sophisticated electronics.

- This is allowing substantial improvements in their operational efficiency, as well as enabling a wider range of new features and functionality to be benefitted from.

- Faced with the integration of more embedded electronics and wireless technologies, test engineers face new challenges.

By Bill Mckinley, Keysight & Matt Hodgetts, Microlease

In many ways the cars that are being introduced onto the market today have much more in common with computing devices than they do with their predecessors. They will, in some cases, need to process in excess of 25Gigabytes of data per hour in order to fulfill all their assigned tasks. Figure 1 (courtesy of Statista) illustrates how the percentage that the electronics content contributes to the total cost of a car has risen over the decades (and is expected to keep rising).

Figure 1: Automotive electronics cost as a percentage of total car cost worldwide from 1950 to 2030 [Source: Statista]

Until now the impetus for implementing digital technology into automotive designs has been mainly for the purpose of eliminating mechanical elements. Through this, marked reductions in vehicle weight are now being witnessed – leading to a significant boost in fuel economy figures. This is just one dimension, however, and there are a multitude of other roles it could potentially perform that are currently being investigated in earnest – such as enhancing the overall driving experience, keeping vehicle occupants away from potential harm and providing better connectivity with the outside world.

Vehicles manufacturers are moving ever closer to their goal of the ‘connected car’. Such vehicles will integrate systems supporting a broad array of different communication technologies – and through these it will be possible to address issues relating to driver/passenger comfort and safety, as well as vehicle security. It will also make it easier to ensure the vehicle is kept in good working order and that maintenance/repair requirements are identified in a timely manner.

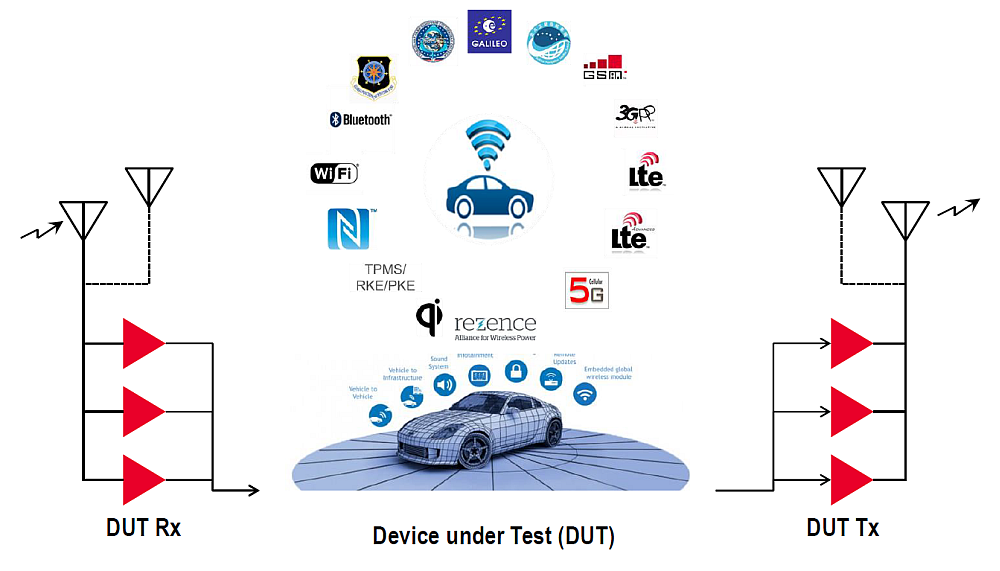

Industry analysts firm Gartner has forecast that by 2020 there will be over 250 million connected cars on our roads. These vehicles will employ numerous different wireless protocols – WLAN, LTE, Bluetooth, NFC and ZigBee among them (see Figure 2 for more details). This presents vehicle manufacturers and their technology partners with a sizeable, and multifaceted challenge. Not only do they need to derive an accurate benchmark of each of these protocols in isolation, on top of this they must gain a firm grasp of how the wireless signals will interact with one another and also what influence the extremely difficult automotive environment in which they are located is likely to have on performance.

Figure 2: Wireless Technologies Used by Connected Cars

Key Areas for Connectivity

There are several different parts of a vehicle’s operation where the heightened degree of connectivity now envisaged is destined to have real value. These are as follows:

- Infotainment & Communication – This will mean that the connectivity which people take for granted in every other aspect of their daily lives is available to them inside their cars too. Smartphones will be wirelessly hooked up to the vehicle, allowing hands free operation to be initiated and the sharing of multimedia materials. Likewise other portable electronics devices (such as tablets) could be used by passengers located in the backseats to connect to the Internet, so they are able to download music, stream videos or engage with social media platforms.

- Telematics – This will cover a broad range of different tasks that need to be executed by the vehicle. Already data is transmitted wirelessly for tyre pressure monitoring (usually via Zigbee) and remote keyless entry to vehicles (through ISM bands). This is helping to keep the cost and weight associated with cable harnessing to a minimum. Moving forward it will not only be aimed at benefiting the driver/passenger though. Gaining access to telematics data will enable fleet tracking and prevent theft. It will also mean that insurance companies are able to assess what were the circumstances that led to an accident. It will enable the transfer of information regarding on-board diagnostics too, so that servicing can be carried out more effectively.

- Vehicle ADAS – The Advanced Driver Assistance System (ADAS) technology now being incorporated into vehicles is slowly moving us closer toward fully autonomous vehicles. Vehicle radar is already enabling collision avoidance and lane change assistance mechanisms to be taken advantage of. Through Vehicle-to-Vehicle (V2V) and Vehicle-to-Infrastructure (V2I) communication, valuable data will be transferred wirelessly between vehicles in relatively close proximity with one another (as well as traffic lights, speed signs, etc.) pertaining to possible road hazards, congestion problems and suchlike. Functionality of this kind will reduce driver frustration and increase the safety of vehicle occupants. In the US, the National Highway Traffic Safety Administration is putting legislative measures in place that will mean all new cars and trucks being produced will need to include V2V technology.

|

Telematics |

Infotainment |

ADAS |

| FOTA Updates

Vehicle Tracking Fleet Management Insurance Services Navigation Vehicle Diagnostics Service Notifications/Recalls Battery State for EVs Safety (OnStar, eCall) Eco Driving Remote Lock/Unlock |

Broadcast/Internet Radio

News/Sports/Business Digital TV Streaming Music Services Live Traffic Updates Weather Updates Social Networking Web Browsing Smartphone Connectivity Gaming Retail Opportunities 3rd Party Apps (Park Assist) |

V2V, V2I, V2X

Emergency Brake Assist(EBA) Adaptive Cruise Control (ACC) Surround View Blind Spot Detection (BSD) Rear Cross Traffic Alert Lane Departure Warning (LDW) Lane Keeping System (LKS) Traffic Sign Recognition (TSR) Intelligent Headlights Auto Emergency Braking (AEB) |

Figure 3: Example applications for wireless connectivity in telematics, infotainment and ADAS

Figure 3 gives further details about some of the different applications that are encompassed in each of these 3 areas. Leading vehicle brands, of course, want to provide car buyers with all the extra capabilities that have been outlined, but given the highly competitive market they need to be able to do this in a way that doesn’t bring excessive additional costs with it. It is crucial, therefore, that testing activities do not slow down the production process or require allocation of extra engineering resources.

Principal Test Requirements

Though in the telecoms sector, data rates are the overriding concern, for connected cars it will be low latency and elevated reliability that matter. Through the test equipment they have sourced, engineers need to be able to not only verify performance of the automotive wireless technologies being utilized, but in addition carry out comprehensive interference and interoperability tests. So, in addition to rapid throughput, a breadth of test parameters is basically mandatory.

Scalability is also of great importance. Testing within a laboratory scenario is just the beginning. The product lifecycle as a whole has to be adequately attended to, not just isolated elements. Once the necessary tests have been accomplished during the development phases, these activities need to be ramped up to meet mass production demands. It is important that the specified equipment is able to deal with this migration.

The Role of 802.11p in Connected Cars

802.11p looks likely to see widespread adoption. This is an approved amendment to the universally recognized 802.11 WLAN standard. It deals with wireless access inside an automotive setting and will support Intelligent Transportation System (ITS) applications as they start to emerge. Occupying the 5.9GHz frequency band, 802.11p utilizes a series of 10MHz wide channels (6 service channels, plus 1 addition channel for control purposes). The priority with this protocol is not offering a high data capacity, it is about establishing a highly reliable, low latency wireless data link. This more deterministic technology will make it possible for V2V/V2I communication to be implemented. A vehicle will be able to broadcast data relating to its current position and the speed/direction in which it is travelling. This data may then be picked up and, if necessary, acted upon by other vehicles that are in the vicinity.

Optimized for 802.11p testing activities (as well as supporting many other wireless standards), the Keysight MXA N9077A-2FP presents engineers with a complete transmit test system. It has the capacity to perform comprehensive spectrum analysis, plus phase noise and modulation measurements. Furthermore, it is a highly scalable solution that can deal with the expectations of volume manufacturing.

Figure 4: Keysight’s MXA N9077A-2FP which is available via Microlease

Automotive test requirements will change throughout the product lifecycle, and if test activity is to be efficiently carried out, then equipment sourcing capabilities need to reflect this. The chosen equipment supplier should be able to cover early stage development right through to full scale production, so an understanding of the characteristics that define these distinctive settings is essential. All sorts of different scenarios should be catered for, allowing changing circumstances to be reacted to (such as adding provision for an emerging wireless standard, a sudden increase in the number of test units being utilised, whether treating test sourcing as a capital or operational expense proves most suitable, etc.). Consultants may just need a short term rental (for a period of a few weeks perhaps), tier 1 suppliers might want to procure either new or used equipment, automobile manufacturers could be looking to establish a long term leasing agreement (in some cases as much as 5 years) or even a complete asset management package. Furthermore, given the complexity of the technology involved, having access to an engineering support team with extensive application knowledge is of great value. Some suppliers offer very little in terms of after sales services. There are clear benefits to engaging with an equipment sourcing partner who offers a more comprehensive array of services to maximise flexibility. In addition they should be able to take care of maintenance and recalibration work, possibly disposal too.