- Emerson and NI (formerly National Instruments) have announced a definitive agreement under which Emerson will acquire NI for $60 per share in cash, or a net value of $8.2 billion.

- Emerson, a U.S.-based industrial automation solutions specialist, already owns about 2.3 million shares of its Texas-based compatriot, or about 2 percent of the outstanding stock.

“With this expansion into test and measurement, Emerson will strengthen its automation capabilities and gain more customers who rely on NI solutions at critical points in the product development cycle. These capabilities allow Emerson to diversify into attractive and growing markets such as semiconductor and electronics, transportation and electric vehicles, and aerospace and defense,” said Lal Karsanbhai, president and CEO of Emerson.

The $35 billion test and measurement market, according to Emerson, is a fast-growing market that is highly complementary to the markets in which the automation specialist already operates.

Emerson also plans to take advantage of high-growth opportunities in the industrial software business, which accounts for 20 percent of NI’s revenue.

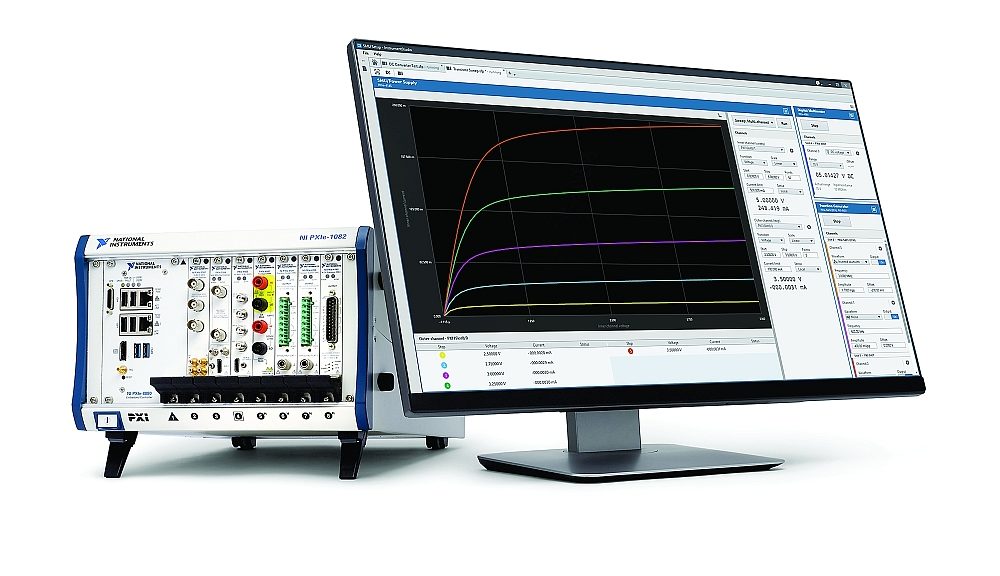

NI is a specialist in modular intrumentation systems and software solutions for test and measurement applications.

Founded in 1976, the Texas-based company developed Labview, its graphical programming platform, in 1986 and invented the PXI modular instrumentation format in 1997. It had sales of $1.66 billion in 2022.

The Austin-based company operates in more than 40 countries, serving about 35,000 customers in the semiconductor and electronics, transportation, aerospace and defense markets.

Founded in 1890 in St. Louis, Missouri, Emerson began as a manufacturer of electric motors and fans. In more than a century, the U.S. firm has expanded its offerings to include solutions and software for industrial process automation and control, and building automation. It has grown from a regional manufacturer to a global group. It employs 85500 people worldwide and has achieved nearly $20 billion in sales in 2022.

The transaction is expected to close in the first half of Emerson’s 2024 fiscal year, subject to the satisfaction of customary closing conditions, including regulatory approvals and NI shareholder approval.