- Synopsys, a Californian specialist in electronic design automation (EDA) software, and Ansys, an american provider of multi-physics simulation and analysis solutions, have entered into a definitive agreement under which Synopsys will acquire Ansys.

- Under the terms of the agreement, Ansys shareholders will receive $197 in cash and 0.3450 of a Synopsys common share for each Ansys share.

- This represents an enterprise value of approximately $35 billion based on the closing price of Synopsys common stock on December 21, 2023.

“The megatrends of AI, silicon proliferation and software-defined systems demand greater computational performance and efficiency in the face of increasing system complexity. The combination of Synopsys’ electronics design solutions and Ansys’ world-class simulation and analysis capabilities will enable us to offer a holistic, powerful and fully integrated approach to silicon-based system innovation to help maximize the capabilities of technology R&D teams across a wide range of industries,” said Sassine Ghazi, president and CEO of Synopsys.

“Since its creation 37 years ago, Synopsys has been at the heart of the worldwide evolution of semiconductors in the fields of computing, networking and mobility, and today at the service of the new era of ubiquitous intelligence. Joining forces with Ansys, a company we know well from our long-standing partnership, is the latest example of how Synopsys stays ahead of the curve,” said Aart de Geus, executive chairman and founder of Synopsys.

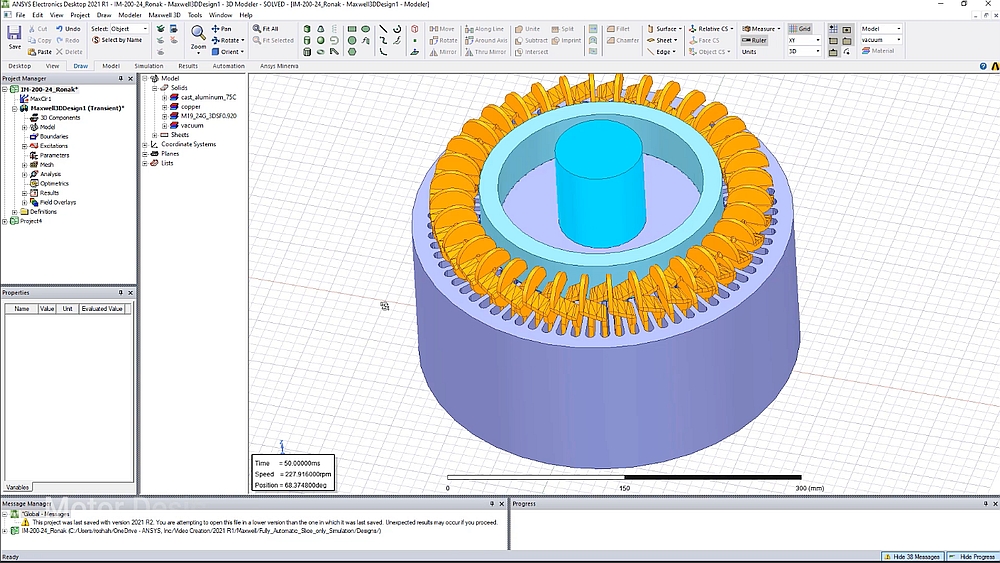

For more than 50 years, Ansys has provided numerical simulation solutions applied to structural mechanics, fluid dynamics, thermal calculation and electromagnetic analysis. These solutions are used to design and develop a wide variety of products, equipment, systems, etc.

According to Ajei Gopal, President and CEO of Ansys, “This combination brings together the highly complementary capabilities of each company to meet the evolving needs of today’s engineers and give them unprecedented insight into the performance of their products.”