- Viavi Solutions and Spirent Communications have announced an agreement on the terms of a cash offer for the acquisition of Spirent by Viavi.

- Viavi is a US-based provider of test and measurement solutions for wired, optical and wireless telecommunications networks and technologies.

- Spirent Communications is a UK-based provider of automated test and quality assurance solutions for networks, cybersecurity and positioning,

- The acquisition price values Spirent at approximately £1,005 million, or $1,277 million based on the exchange rate between the British pound and the US dollar on March 4, 2024.

The acquisition is expected to close in the second half of 2024, subject to shareholder approval and other customary closing conditions. The directors of Spirent who hold Spirent shares have signed irrevocable agreements in favor of the acquisition.

Spirent provides products, services and solutions for the testing of communications technologies, including 5G, software-defined wide area networks (“SD-WAN”), cloud and autonomous vehicles. Spirent’s positioning, navigation and synchronization activities target R&D, verification and integration testing applications.

Spirent Communications has reported sales for 2023 of $474 million, down 22% on the previous year’s $607 million. The company has around 1,500 employees in 11 countries and 25 locations worldwide,

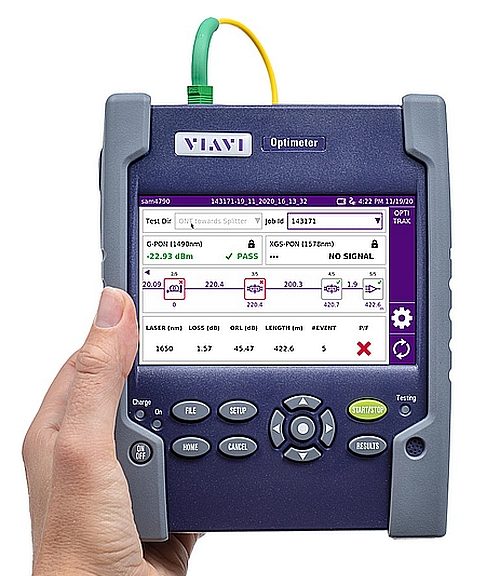

Viavi Solutions, formerly part of JDS Uniphase Corporation (JDSU), is a US company specializing in test, measurement and assurance technologies for wired, optical and wireless networks. The company, based in Chandler, Arizona, manufactures test and inspection equipment for optical networks (OTDRs and fiber optic testers). It also develops optical technologies for applications such as materials quality control, anti-counterfeiting banknotes and 3D motion detection.

Viavi, which employs around 3,600 people worldwide, reported sales of $1.1 billion for its 2023 fiscal year, down 14.4% year-on-year, and a GAAP operating margin of 7.4%, down 690 basis points year-on-year.

Viavi believes that, given the complementary nature of their respective businesses, the acquisition makes strategic and financial sense. It should create a major player in test, assurance and security solutions for research and development laboratories, service providers, data centers and critical infrastructures. The merger of the two companies’ complementary product and service portfolios will provide solutions for a variety of markets and applications.

The acquisition will be financed by Viavi’s existing cash resources, an $800 million 7-year term loan fully committed to Wells Fargo Bank, N.A. and a $400 million investment from Silver Lake. As part of the Silver Lake investment, Ken Hao, President and Managing Partner of Silver Lake, will join Viavi’s Board of Directors. In addition, Viavi has secured a 5-year $100 million revolving credit facility, committed by Wells Fargo Bank, N.A., to provide additional financial flexibility.